Are You A Dislocated Worker Fafsa

Your parent/parents are considered dislocated workers if they: This question asks if either you or your spouse is a dislocated worker.

Financial Aid 101 English Presentation With Joe Mc

If you answer “ yes ,” the financial aid administrator at your college or career school may require proof that your parent is a dislocated worker.

Are you a dislocated worker fafsa. Being a dislocated worker lowers this number, which in turn increases how much federal aid you receive. A dislocated worker qualification can lower your efc and raise the amount of your federal aid award. Does being a dislocated worker affect fafsa?

This does not apply to a parent to voluntarily leaves their job. On the fafsa, dislocated worker may mean several different things. It is unlikely any apply to you, but still look through them to be sure.

Knowing what a dislocated worker can help you out when it comes to accurately answering it on the fafsa. This means any unemployment benefits, relocation assistance, or federal disaster aid must all be reported on your fafsa® application. Fafsa considers you a dislocated worker if you lost your job or got laid off for a reason beyond your control and you don't expect to be able to work in that same role or industry again.

Please check the appropriate box on this form. Image courtesy of the labor tribune. This means any unemployment benefits, relocation assistance, or federal disaster aid must all be reported on your fafsa ® application.

Is receiving unemployment benefits due to being laid off or losing a job and is. In general, a person may be considered a dislocated worker if he or she: Similarly, does being a dislocated worker affect fafsa?

Select “ no ” if your parent isn’t a dislocated worker. Dislocated worker eligibility dislocated worker fafsa. In general, a person may be considered a dislocated worker if he or she:

You may contact the financial aid. Select “ don’t know ” if you’re unsure whether your parent is a dislocated worker. You must still report all income, taxed and untaxed.

If you haven’t, there are actually five different definitions on how to identify someone as one and you only need to identify as one of these five definitions. The form is usually one page long and asks you to check a box indicating your worker status. It sounds to me like you would be considered a dislocated worker.

You are considered a dislocated worker if you: A dislocated worker qualification can lower your efc and raise the amount of your federal aid award. Some of the above programs may ask you whether you are a dislocated worker or displaced homeowner, and if you say you are, you will need to fill out a form to document and verify your status.

Yes, being a dislocated worker affects fafsa. This is question 102 on the paper fafsa. Are receiving unemployment benefits as a result of being laid off.

Have you ever heard of a dislocated worker? Tips for documenting dislocated worker status. You must still report all income, taxed and untaxed.

Furthermore, what does it mean to be a dislocated worker? This is a parent who has lost their job out of their control. This means any unemployment benefits, relocation assistance, or federal disaster aid must all be reported on your fafsa ® application.

If you must determine if someone is a dislocated worker, you have sole responsibility and must make the determination regardless of whether the person has proof of dislocated worker status—or is receiving dislocated worker services—from the workforce investment system. If you answer yes, the financial aid administrator at your college may require proof that your parent is a dislocated worker. january 2011 edited september 2012 52 replies The fafsa application includes a question about you/your parents dislocated worker status as a way to calculate your expected family contribution (efc).

A dislocated worker qualification can lower your efc and raise the amount of your federal aid award. You must still report all income, taxed and untaxed. The dislocated worker question is not connected to the questions that follow.

On your fafsa you answered “yes” to the question “as of today is either of your parent's, or are you (or your spouse) a dislocated worker?”. According to fafsa, dislocated worker is an occupational category that your parent or guardian may fall into. You would be asked those additional questions(combat pay, child support, etc.) regardless of how you answered the dislocated worker question.

This means any unemployment benefits, relocation assistance, or federal disaster aid must all be reported on your fafsa® application. A dislocated worker qualification can lower your efc and raise the amount of your federal aid award. Dislocated workers are individuals who have lost their jobs due to a layoff.

It is the skip logic that causes this. Before you answer, you will need to check with your parents or guardians to confirm their job status. You must still report all income, taxed and untaxed.

To be a dislocated worker on fafsa, your parent or guardian must be unemployed under certain conditions. Secondly, does being a dislocated worker affect fafsa? Are receiving unemployment benefits as a result of being laid off.

Calameo - Job Loss And The Fafsa

2010-11 Fafsa

Fafsa Walkthrough Article Khan Academy

12 Common Fafsa Mistakes Us Department Of Education

2

Dont Make This Fafsa Mistake Fafsa College Apps Financial Information

Fafsa Workshop Ppt Video Online Download

Fafsa On The Web Preview Presentation - Ppt Download

12 Common Fafsa Mistakes Us Department Of Education

Financial Aid 101 English Presentation With Joe Mc

How To Answer Fafsa Question 83 Dislocated Worker

You Can Afford College Topics We Will Discuss

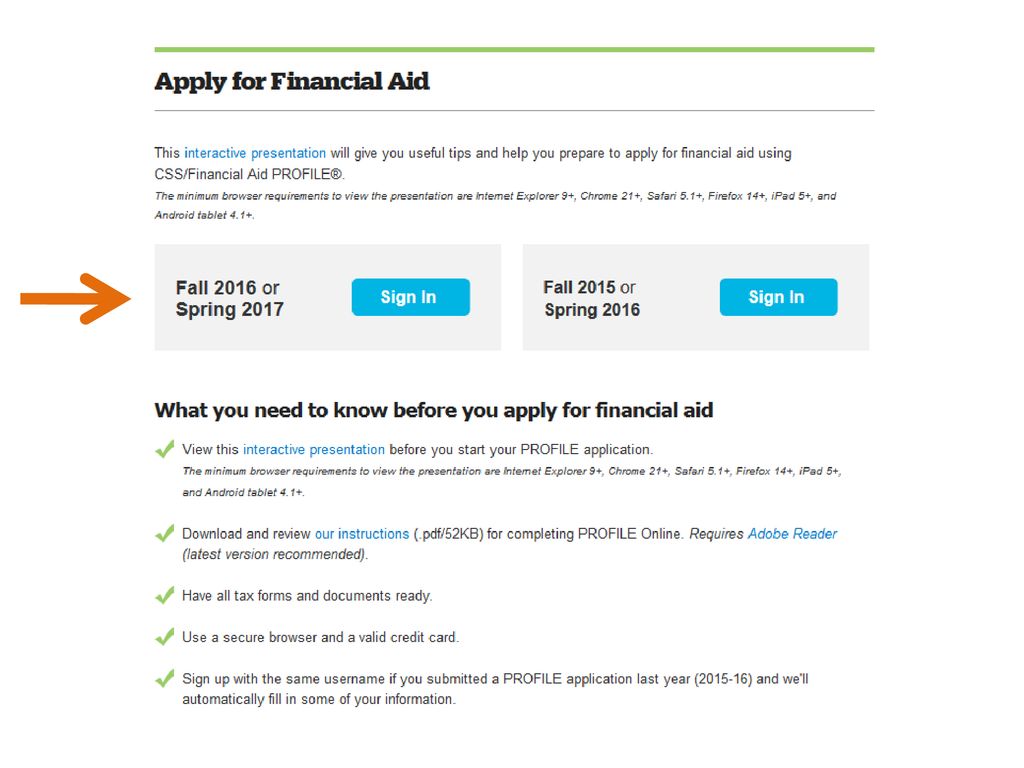

Cssfinancial Aid Profile - Ppt Download

12 Common Fafsa Mistakes Us Department Of Education

Calameo - Appeal Letter For Financial Aid

12 Common Fafsa Mistakes Us Department Of Education

How To Answer Fafsa Question 102-106 Fafsa Sign Off

What Is A Dislocated Worker On The Fafsa - Frank Financial Aid

Fafsa Basics Parent Assets The College Financial Lady